Table of Content

The average rate for a 30-year jumbo mortgage is 6.61 percent, a decrease of 2 basis points over the last week. A month ago, jumbo mortgages' average rate was higher, at 6.84 percent. The average rate for a 30-year fixed mortgage is 6.60 percent, down 3 basis points over the last week. Last month on the 16th, the average rate on a 30-year fixed mortgage was higher, at 6.85 percent. Review them below, and compare rates, loan amounts, terms and other factors to determine which option works best for you. When you're looking for low interest rates on a loan, there's no clear-cut answer to which is better.

Equity bank’s terms and conditions might vary with time as well as the rates. So feel free to look at experts’ tips and make the right decision. If you do, lenders will then take into account your credit score, income and current DTI to determine whether or not you qualify and your interest rate.

How to Establish Credit

You can borrow up to 89% of the CLTV ratio on your property. Right now, however, Old National’s home equity loans are only available in Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota and Wisconsin. You can also use a home equity loan in the event of an emergency like unplanned medical expenses.

Others see the Fed pulling back at the end of the year. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. When you close a personal loan with us, you can easily drive home that perfect car, take out the boat, get away in your ice house or plan the other escape you’ve been dreaming of!

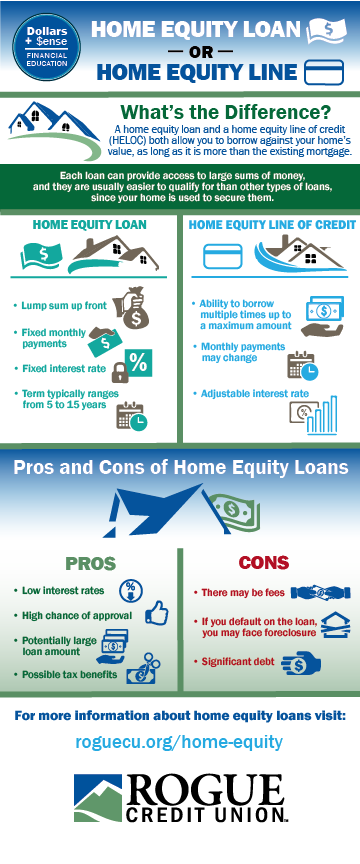

Here for a Home Equity Loan or Line of Credit?

Outside the digital world, Marc can be found spinning vinyl, threading reel-to-reel tapes, shooting film with his Bolex and hosting an occasional pub quiz. Whether you are buying your first home, a vacation home, are relocating or looking to refinance your existing mortgage, we have a mortgage program tailored to your needs. The average rate on a 5/1 adjustable rate mortgage is 5.46 percent, falling 2 basis points over the last 7 days.

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Can help with mortgages, refinances and other home-related loans.

How do I calculate how much equity is in my home?

Check out our current promotions and exclusive offers, all wrapped up for you to enjoy. You can get product, rate and fee info after you choose your location. A first mortgage is the primary lien on the property that secures the mortgage and has priority over all claims on a property in the event of default.

Compared to a shorter-term mortgage, such as 15 years, the 30-year mortgage offers more affordable monthly payments spread over time. With a home equity loan, you typically receive a one-time lump sum of money at a fixed interest rate that you then repay over time. With a home equity line of credit , the lender provides a credit line at a variable or floating interest rate that you can draw on as needed, up to an agreed-upon limit. Offering quality service for over 50 years, U.S. bank has some of the best home equity loans for borrowers with great credit.

While we adhere to stricteditorial integrity, this post may contain references to products from our partners. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

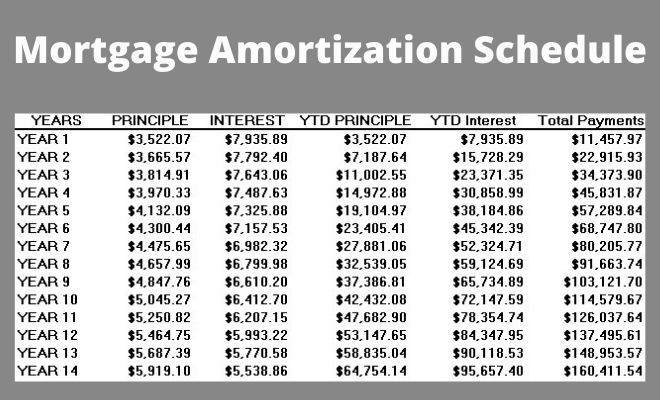

It's important to carefully consider whether a home equity loan is right for you before applying for financing. Can provide funding for a fixed-rate mortgage portfolio or other loan type where the customer has an option to prepay the loan. At the average rate today for a jumbo loan, you'll pay principal and interest of $641.30 for every $100,000 you borrow.

Adulting is hard – from house projects to your kids’ college tuition or even medical bills, life moves pretty fast. So, let us help you manage it by leveraging the equity in your home. Home equity loans are available in Pennsylvania and Maryland only. Spend, save, borrow, invest and protect your money with Equity Bank. All new and existing loans (including Micro-Finance and Mobile) and all Credit Cards. It is an easy process to get a mobile loan at Equity Bank if you abide by the above-mentioned steps.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

The bank has been able to meet the needs of many clients locally and in other parts of the world. Customers can apply for loans from Equity Bank without any qualms and whenever in need. The bank is more than willing to serve its esteemed customers on daily basis. All clients need to know while seeking loans is that interest rates are subjected to change with time and terms and conditions of application. Hence, it is wise to talk to Equity Bank staffs and make inquiry when stuck. Equity bank Kenya mortgage loans have been a great blessing for many dream home chasers.

The average 15-year fixed-mortgage rate is 5.99 percent, down 2 basis points over the last seven days. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. At Bankrate we strive to help you make smarter financial decisions.

No comments:

Post a Comment